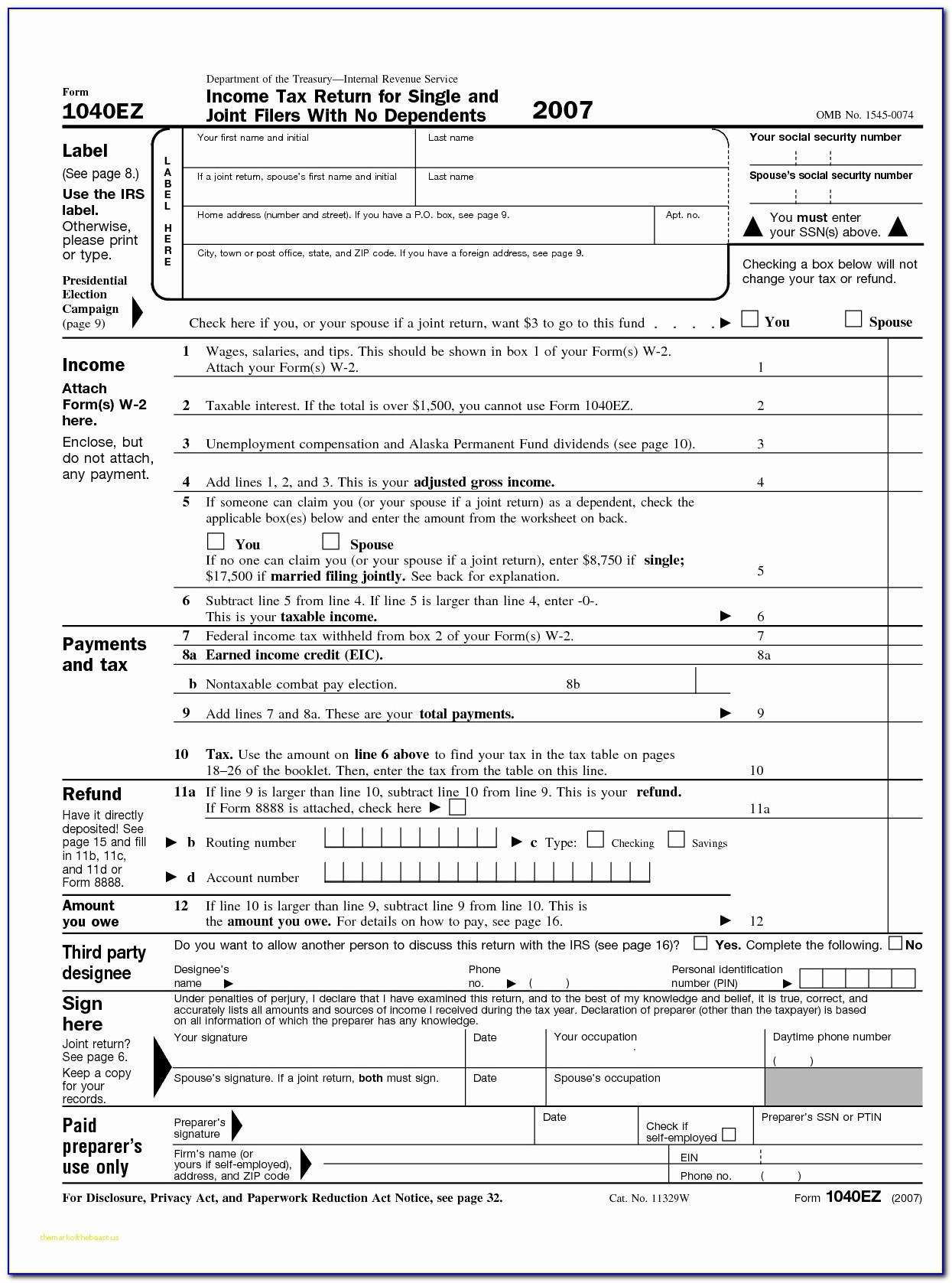

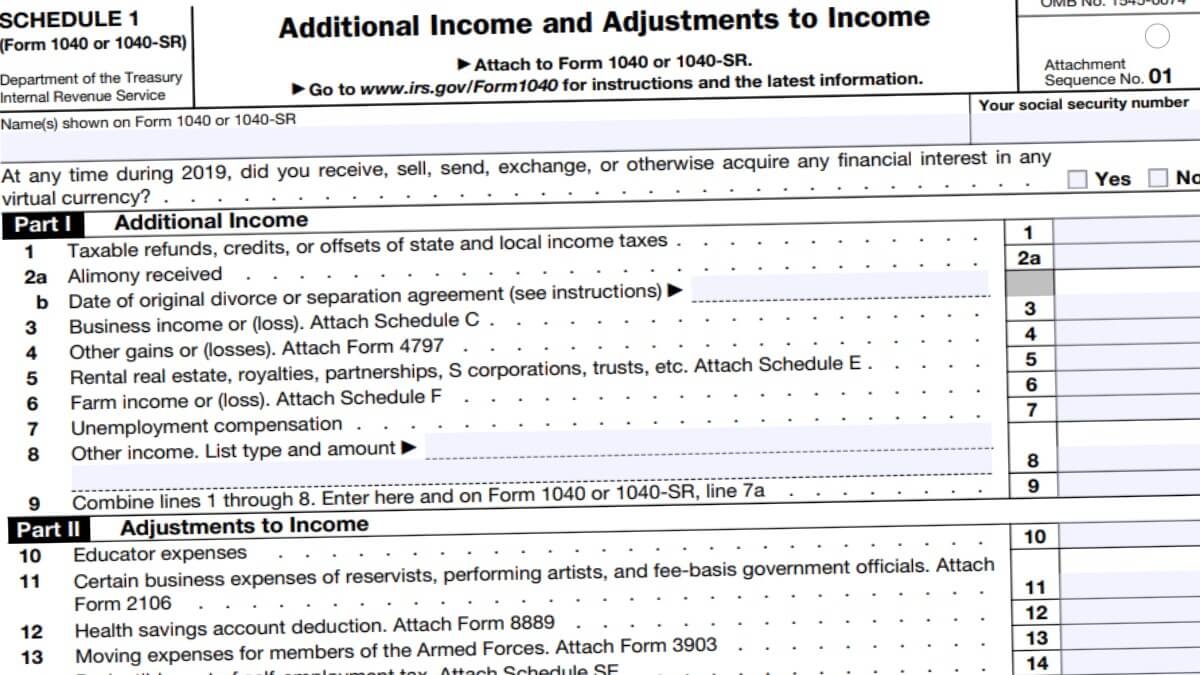

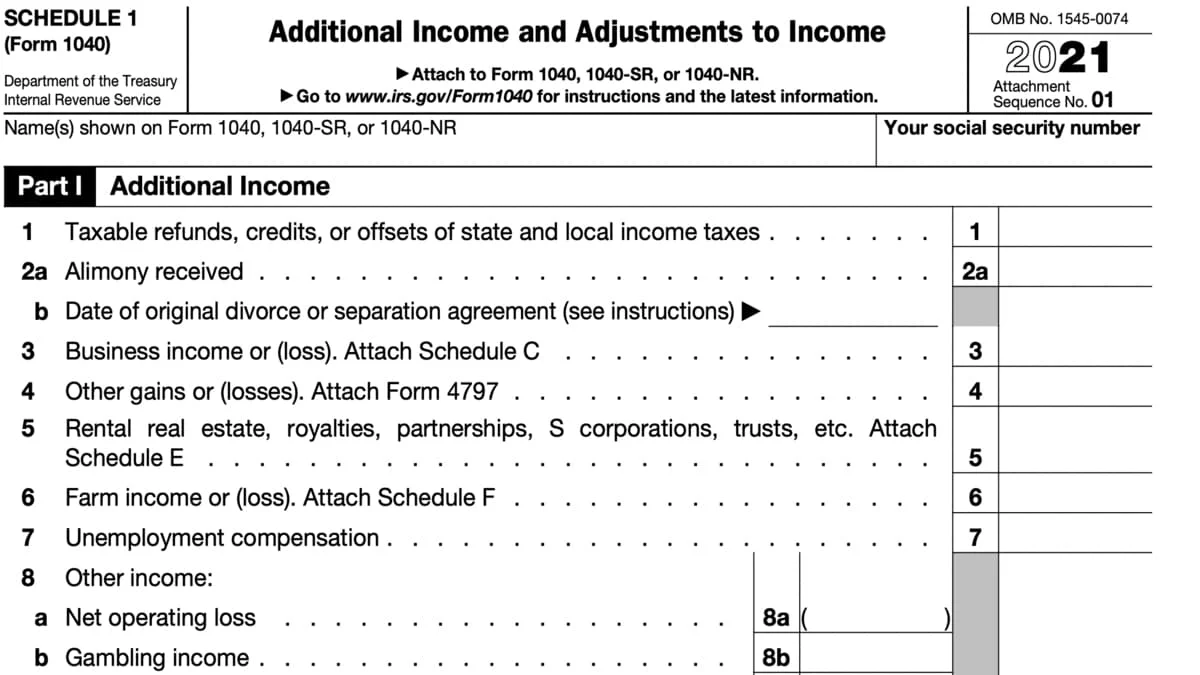

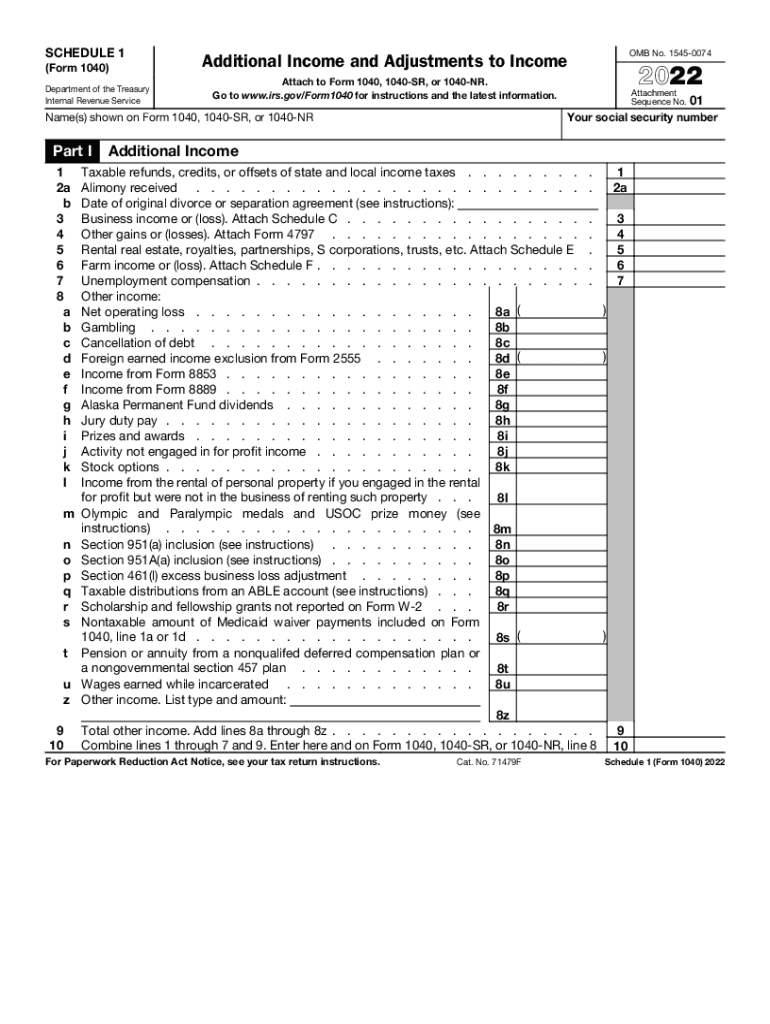

Irs 2025 Schedule 1

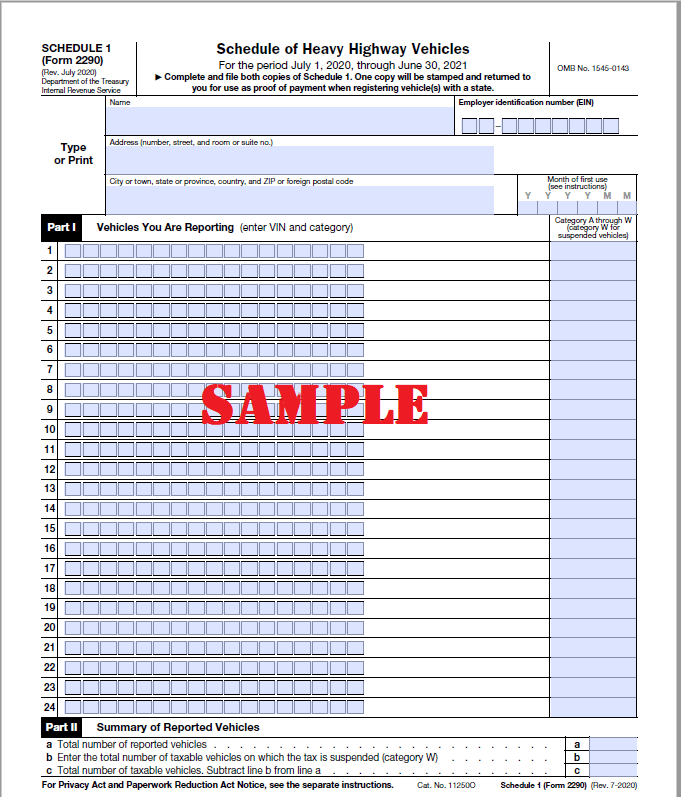

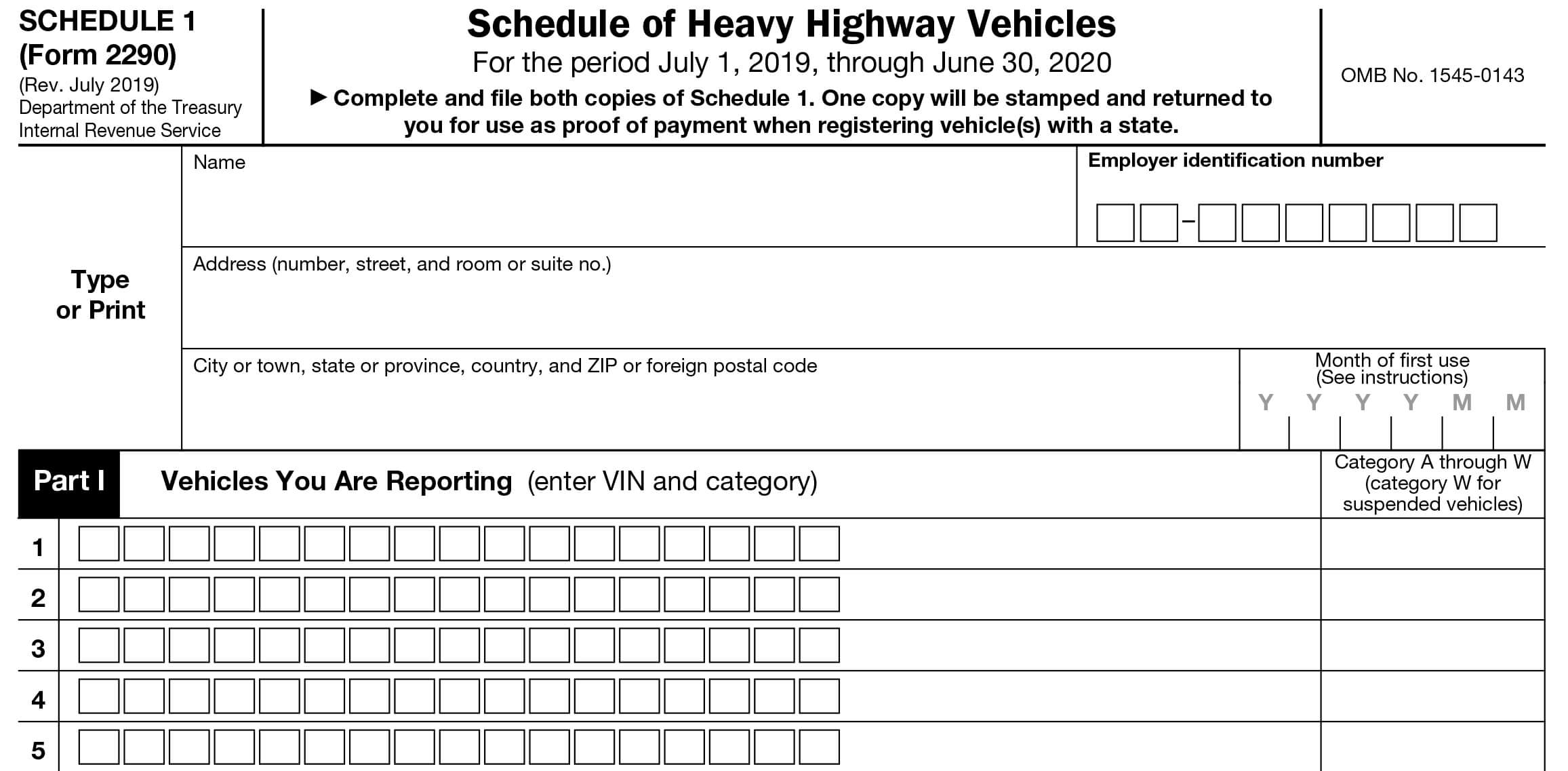

Irs 2025 Schedule 1 - Irs Tax Filing 2025 Rahal Claresta, Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first. Skip to main content skip to primary sidebar See current federal tax brackets and rates based on your income and filing status.

Irs Tax Filing 2025 Rahal Claresta, Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first.

Irs Tax Refund Schedule 2025 Ashli Camilla, The limit is $4,300 if you are single.

Irs 2025 Schedule 1 Rikki Kirsteni, The limit is $4,300 if you are single.

Are Home Office Expenses Deductible In 2025. As an employee,…

Irs 2025 Schedule 1. Your bracket depends on your taxable income and filing status. First, determine your expected adjusted gross income (agi), taxable income, taxes, deductions, and credits for.

2025 Tax Calculator Federal Irene Howard, The 2025 hsa contribution limit for.

Unl Academic Calendar Fall 2025. Additionally, these dates are subject…

Irs.gov Form 1040 Schedule B at viiarmandoblog Blog, The 2025 hsa contribution limit for.

2025 World Cup Qualifying Groups Europe. The 12 group winners…

Irs 2025 Schedule 1 Rikki Kirsteni, Married taxpayers filing jointly 2025 projected tax brackets.

Florida Tax Free 2025 Schedule 1 Molly Lewis, Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first.